Has the pandemic increased your stress about money and finances? Do your personal finances cause you stress? Well, it doesn’t have to! I have some tips to help you stay on top of your finances and improve your financial wellness.

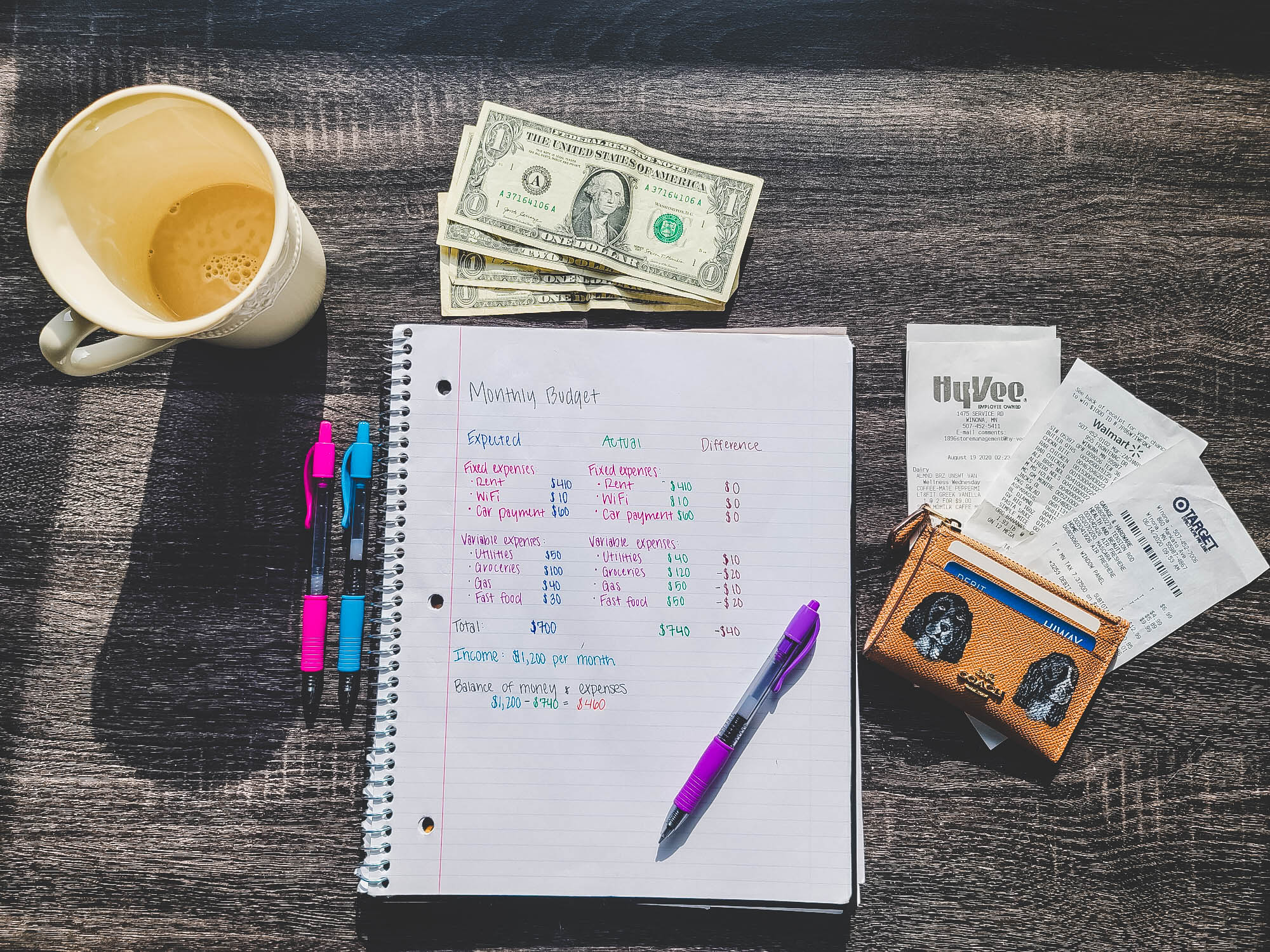

To be able to effectively manage your money and budget, you need to first understand how much money you spend, how much you make and how much you pay in fixed and variable expenses.

A fixed expense is an expense that is the same each month and is paid regularly. This could be things like WiFi, rent, insurance or a vehicle payment.

A variable expense is an expense that is not consistent and can change from month to month. This could be things like gas for your car, groceries, or utilities.

How to Make A Monthly Budget

Building a budget can sometimes seem like a daunting task, but it doesn’t have to be if you follow these 6 easy steps:

1.Gather Your Financial Paperwork

Financial paperwork can include but is not limited to, bank statements, utility bills, credit card bills, receipts, pay stubs, and investment accounts.

2. Calculate your Income

Determine how much money you make a week and then use that to calculate how much you make in a month.

For example, let say you make $10 per hour and work 20 hours a week, so you take $10 per hour and multiply that by 20 hours which equals $200. There are four weeks per month, which means you would make around $800 per month (not factoring in taxes).

3. Create a List of Monthly Expenses

Monthly expenses can include but are not limited to things like groceries, car payments, rent, loans, phone bill, insurance payment, Wi-Fi, and any subscriptions you have (e.g., Netflix, Hulu, Spotify).

4. Determine Your Fixed and Variable Expenses

Remember fixed expenses are the same each month and variable expenses change from month to month.

5. Total Your Monthly Income and Expenses

Look at how much you earn each month and how much of that you spend. Are you spending more than you make? Are you making more than you spend?

6. Make Adjustments to Expenses

If you spend more than you make in a month or don’t have enough money to pay your expenses, it may be time to adjust your spending patterns or find a job to help pay for those expenses.

Financial Wellness Tik Toks

Follow @WSUHealth on Tik Tok for financial wellness tips such as where to use a student discount and how to save money on coffee!

Free Budget Apps

Here are some free apps that can help you track your spending, help you establish a budget, and even notify you if you are getting close or have exceeded your budget limits.

Get in control of your finances and stop letting your finances control you buy following these 6 simple steps to keep your budget in check.

If you are in search of a job, looking to beef up your resume, need help writing a cover letter or want to participate in a mock interview connect with WSU Career Services.